- #BLUETOOTH CREDIT CARD READER SQUARE HOW DO I CONNECT HOW TO#

- #BLUETOOTH CREDIT CARD READER SQUARE HOW DO I CONNECT FREE#

(Some, like Shopify, will charge you extra if you use a different payment processor.) This step depends on whether you are integrating your credit card payment processor into a POS system or website you already have or using tools provided by the merchant or card processor service.

Accepting credit card payments is a must-have in today’s consumer environment, whether you are a small business owner with a brick-and-mortar store, a stall at the farmers market, or an online shop. Further, the total spending of non-in-person, not-a-bill payments increased for grocery stores, restaurants, and retailers. However, if you are a high-volume business wanting interchange-plus pricing or a high-risk business needing a more specialized processor, then you need a few more steps to get your merchant account.Īccording to the 2021 Diary of Consumer Payment Choice, consumers used cash for only 19% of payments in 2020, down 7% from 2019. If the credit card processing service you’ve chosen is a payment service provider, you may simply need to sign up with your contact information. You still need a merchant account or payment service provider most merchant and payment providers already give you a gateway.

#BLUETOOTH CREDIT CARD READER SQUARE HOW DO I CONNECT HOW TO#

How to Find the Cheapest Credit Card Processing For Your Business

#BLUETOOTH CREDIT CARD READER SQUARE HOW DO I CONNECT FREE#

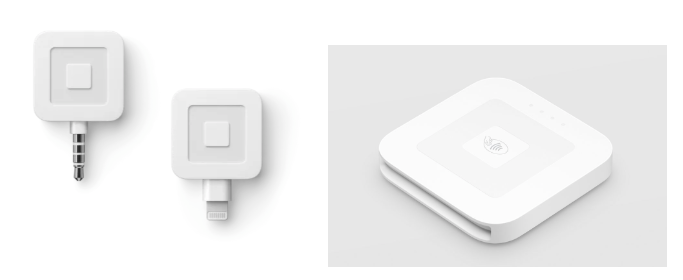

Others offer hardware free with certain conditions. Do you need POS hardware? Most services charge extra for POS systems.How worried are you about chargebacks? While all merchant services provide some fraud protection, many waive chargeback fees or offer additional chargeback services.Some process ACH transfers (which are cheaper for invoicing) and incorporate payments straight into your accounting software. Do you have subscription-based products or services or recurring billing? Some services offer special rates for invoicing, while others have tools for recurring payments.Will you take payments at the table, curbside, or off-site locations? Credit card processors with mobile processing apps and tools are best for taking payments on the go.Sometimes, processors will charge additional monthly fees to access certain features like online payments or invoicing.

Will you process most of your credit card payments in-store or online? While many credit card processors can handle both, most focus on one area.On the other hand, if you process credit cards infrequently, an option with no monthly fees or obligations would suit your needs better. Approximately how much will you process in a month? If you process over $10,000 a month regularly, then an interchange-plus provider may be more cost effective.

0 kommentar(er)

0 kommentar(er)